Capital One

91% of applications for credit cards are denied because applicants overestimate their eligibility. Capital One checks if you qualify without a hard credit pull, but the process is confusing and needs major improvement.

GOALS

Optimize the customer experience to drive approved credit card applications.

Confirm qualification status before the application is submitted and adjust product messaging.

PROBLEMS

Declined applications cost money.

Rejected applicants are unlikely to reapply for a different product.

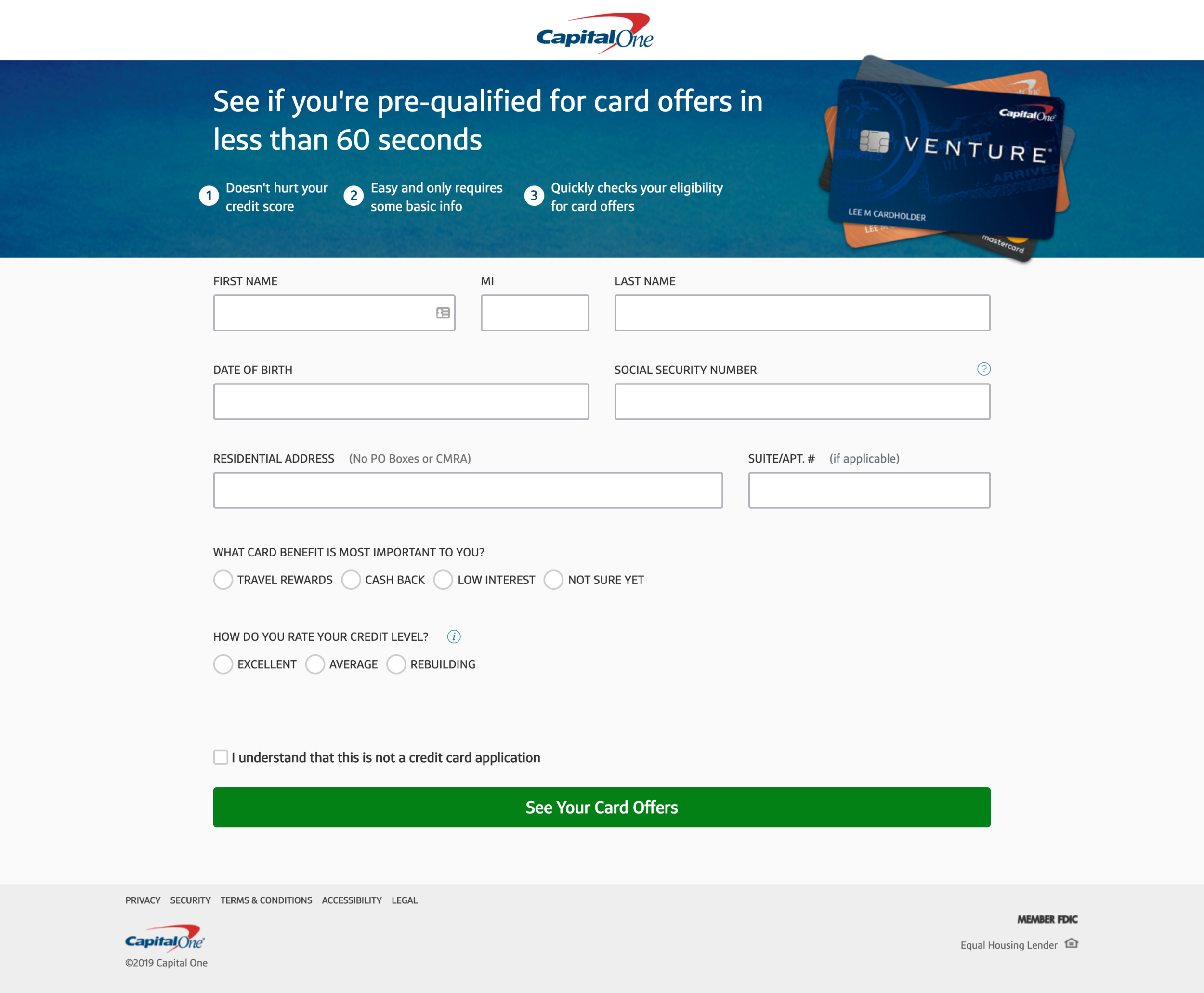

The Original

Step 1

Fill out the Pre-Qualification form.

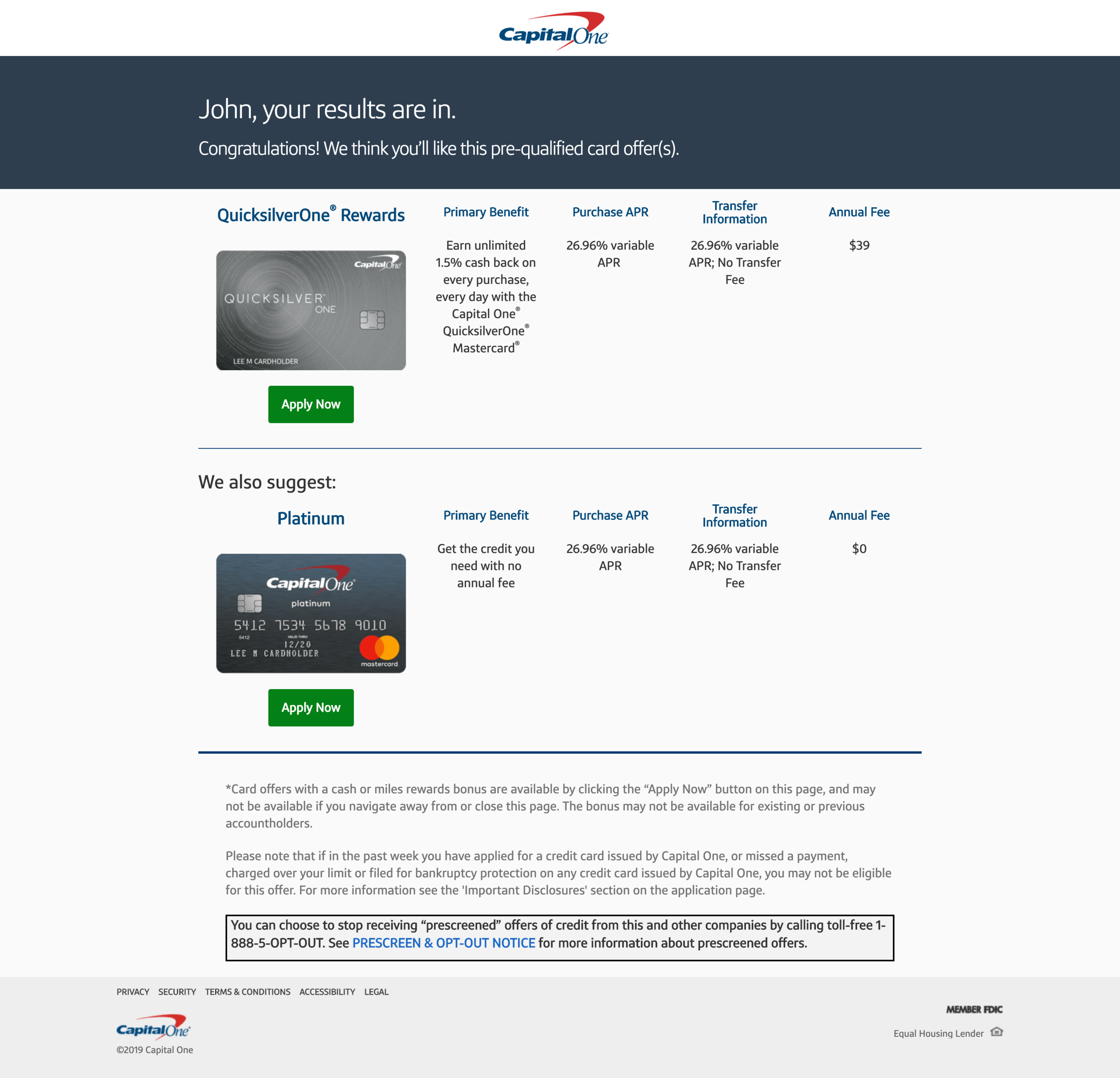

Step 2

Pick a credit card.

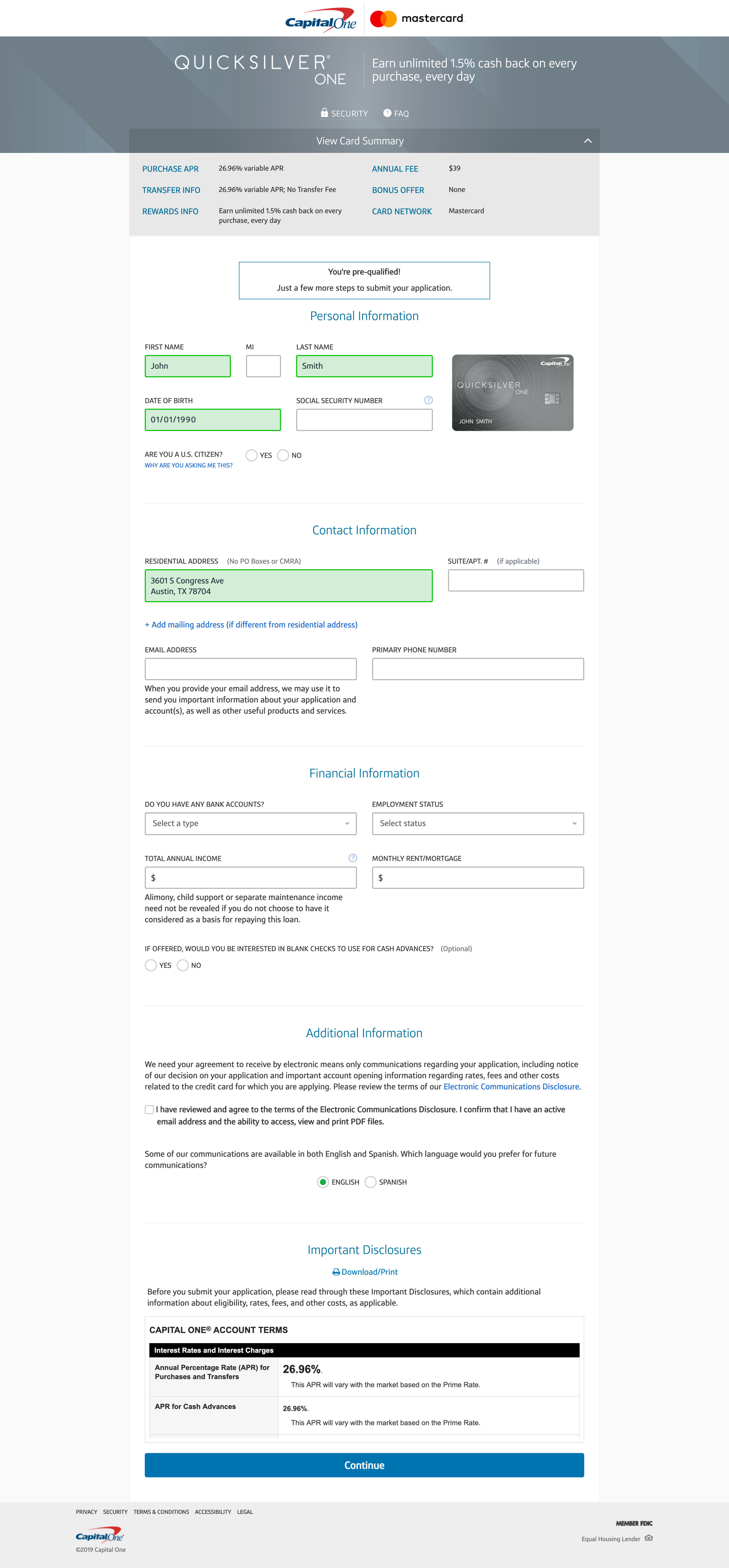

Step 3

Submit a really long application form.

The Concepts

The Redesign

SCENARIO 1

Qualified for the card!

The applicant successfully qualifies for the card. The pre-qualification form has been combined with the application to check status and reduce the number of steps and form fields that need to be filled.

Scenario 2

Didn’t qualify for the card…

If a user fails the pre-qualify step, two more credit cards are suggested and the user can continue the application process.